The Indian stock market has always been the epicenter for investors looking to grow their wealth, captured in the imagination of the masses in popular films like Scam 1992 amongst others. With the dematerialization of securities and the electrification of trading processes, there has been a surge in the demand for stock market advisory services. Investors recognize that expertise is the name of the game, and knowledge of the complexities of the market is at an all-time high value to us.

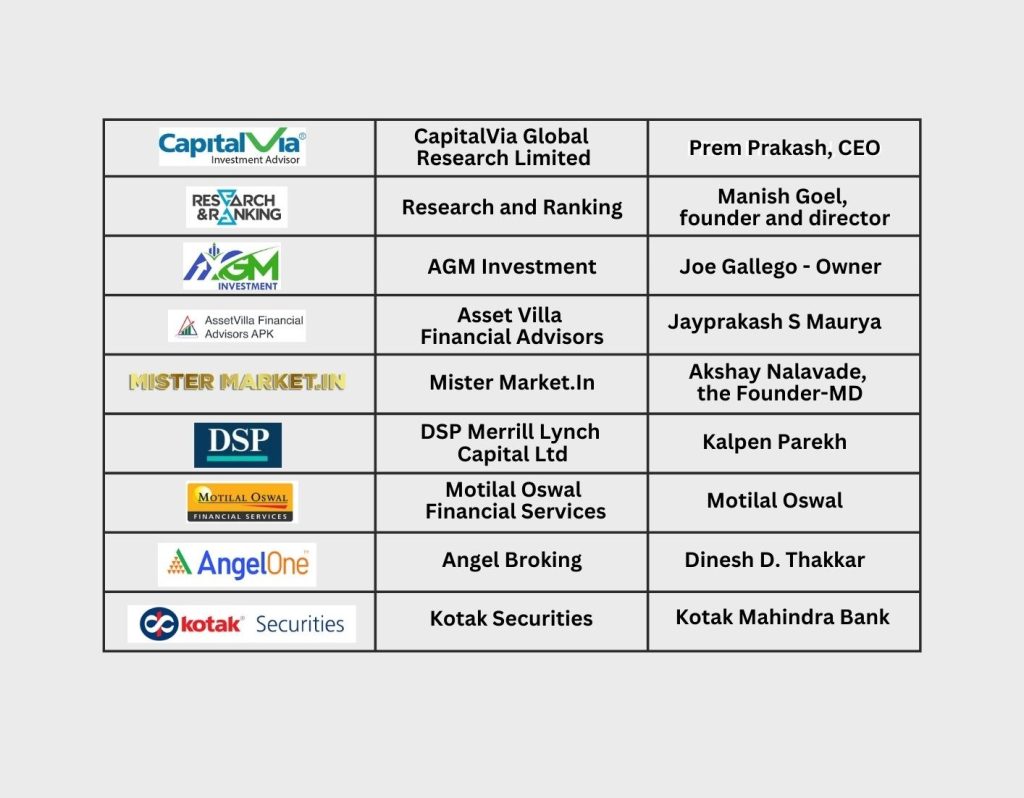

That being the case, in this blog, we’ll explore the top 10 SEBI registered stock advisory companies in India that have been particularly lucrative for investors who subscribed to their services.

Streetgains

Streetgains is a leading provider of online trading solutions, financial planning, and stock advisory services. Their commitment is not just to be a trading calls provider but a trusted partner in clients’ journeys toward financial success through their subscription model. Their numbers speak for themselves, considering a journey of just 7 years.

CapitalVia Global Research Limited

Founded in Mumbai in 2006, CapitalVia Global Research Limited stands as the oldest independent stock market advisory firm in India. Over 75,000 clients have benefited from the company’s research-based trade recommendations. The firm houses a NISM-certified research team guiding stocks, commodities, derivatives, and currencies.

Research and Ranking

Established in 2016, Research and Ranking is a technology-enabled stock market advisory company based in Mumbai. The company has served over 12,000 clients, focusing on leveraging technology for wealth creation.

Equentis Capital, the parent company, has been involved in the Indian stock markets since 2009.

AGM Investment

Founded as AGM Capital in late 2015, the company provides financial advisory, debt syndication, and private equity services. AGM Investment, established by Navneet Maheshwari, has learned from market ups and downs and serves over 500 clients. The emphasis is on offering the right investment options and education for informed decision-making.

Asset Villa Financial Advisors

Based in Mumbai, Asset Villa Financial Advisors is a one-stop advisory service provider covering stocks, mutual funds, insurance, and various asset classes. With around 2500 clients, the company is gradually expanding its services to other parts of India. The full-service approach allows clients to access comprehensive financial guidance under one roof.

Mister Market.In

With a modest initial investment of Rs. 50,000, Mister Market. It has quickly become a leading name in investor education. Onboarding 100 clients within the first month of operation reflects the brand’s popularity among aspiring investors. The company focuses on providing training to the growing population of stock market traders and investors.

DSP Merrill Lynch Capital Ltd

Established in 1975, DSP Merrill Lynch Capital Ltd. is a leading investment banking firm recognized for its comprehensive suite of services and commitment to investor education. Beyond traditional investment banking activities like research and equity sales, DSP Merrill Lynch offers clients a wider range of solutions including futures and options trading, security-based lending, and stockbroking services. The firm distinguishes itself through its dedication to ethical practices and financial literacy.

Motilal Oswal Financial Services

Motilal Oswal is a well-established financial services company with a significant presence in the Indian stock market. The firm offers a range of services, including equity and commodity trading, wealth management, and investment advisory. Motilal Oswal’s research-driven approach provides clients with valuable insights for making informed investment decisions.

Angel Broking

With a history dating back to 1987, Angel Broking is one of the oldest stockbroking firms in India. The company has adapted to technological advancements and offers a robust online trading platform. Angel Broking provides a diverse range of advisory services, including research reports and personalized investment recommendations.

Kotak Securities

Kotak Securities is a subsidiary of Kotak Mahindra Bank and is recognized as one of the leading stockbroking firms in India. The company offers a wide array of financial products and services, including stock trading, mutual funds, and portfolio management. Kotak Securities’ research team provides clients with market insights and investment strategies to optimize their portfolios.

These top 10 SEBI-registered stock advisory companies in India are playing an important role in guiding investors through the complexities of the stock market. Although there are plenty of other firms that are following in the footsteps of the aforementioned companies, when it comes to providing research-based recommendations to offering educational resources, these firms contribute to the financial success of their clients in a truly unique way. However, investors need to conduct thorough due diligence, including verifying SEBI registration details, before selecting an advisory service. With the right guidance, investors can make the right choices and be confident about making them.

Disclaimer:

The content in this blog is intended for informational purposes only and does not constitute investment advice, stock recommendations, or trade calls by Streetgains. The securities and examples mentioned are purely for illustration and are not recommendatory.

Investments in the securities market are subject to market risks. Please read all related documents carefully before investing.

FAQs:

-

1. How to earn money daily from trading?

Earning money daily from trading involves strategies like day trading, where traders capitalise on small price movements within the same day. Success requires real-time market analysis, quick decision-making, and risk management.

-

2. How to earn money from equity trading?

To earn money from equity trading, you need to buy stocks at a lower price and sell them at a higher price. Success depends on researching companies, analysing stock trends, and using technical or fundamental analysis.

-

3. How to earn money from share trading in India?

In India, share trading offers profit potential through buying and selling stocks on exchanges like the NSE and BSE. To maximise returns, traders should use market research, tools like technical analysis, and risk management strategies.

-

4. How to make money from share trading in India?

Making money from share trading involves selecting the right stocks, timing the market, and implementing trading strategies like swing trading or day trading while staying informed about market trends.

-

5. How to transfer money from a trading account to a bank account?

To transfer money from your trading account to your bank, log into your trading platform, navigate to the funds section, and initiate a withdrawal request. The money will typically be credited to your linked bank account in 1 to 3 days.

-

6. How to withdraw money from a trading account?

You can withdraw funds by logging into your trading account, selecting the withdrawal option, and selecting the amount to transfer to your bank account. Ensure your bank account is linked and follow any steps your broker requires.

Subscribe to our Credits-Based Research System:

Pay only for successful research calls!